Aligning Capital with Impact: Introducing S2G’s Theory of Change

At S2G, we believe that financial performance and impact outcomes are deeply connected. The past year has reinforced that as climate risks rise, food security pressures intensify, and new technologies from AI to biotechnology reshape industries, the companies that build strong operational foundations and deliver measurable value through their products and services are the ones proving most resilient and best positioned for growth. Building on this conviction, we have introduced our Theory of Change (as highlighted in the S2G Annual Report), a framework that seeks to guide new investments and map our portfolio to the long-term impact outcomes we aim to achieve.

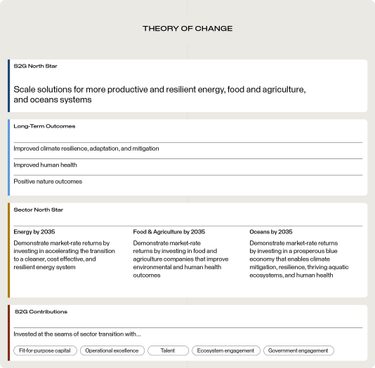

S2G’s Theory of Change is distilled in our firm’s mission: To scale solutions for more productive and resilient food and agriculture, energy, and oceans systems, while targeting strong, market-leading returns.

To advance this mission, we’ve had a dedicated Impact Measurement & Management (IMM) function since 2022. From the outset, we have viewed IMM as more than a box-checking exercise. We define IMM as the practice of setting clear impact goals at the time of investment, tracking performance, and using this information to guide decisions, enhance positive impact, and strengthen financial value over time.1 Over the past three years, we’ve positioned IMM as a strategic discipline integral to driving sustainable business performance.

“Impact”: The positive and measurable change in social or environmental outcomes that result from what we invest in, and what we do to add value.(2)”

In the past year, we further formalized our IMM approach by strengthening the tools, governance, and frameworks that support how we put IMM into practice. We developed standardized criteria for risk assessment; reinforced accountability through added capacity and internal governance; and clarified our impact strategy with theories of change and shared impact objectives, or “North Stars.” Together, these steps aim to connect our investment strategy to the impact outcomes we seek, and enable more consistent measurement and reporting, deeper insights for decision-making, and greater transparency with stakeholders.

Our Theory of Change

Our Theory of Change is the foundation of our IMM approach. It seeks to connect the investment capital we deploy to the long-term systemic change we look to support, and aims to offer a clear and transparent way to articulate how our strategy translates into measurable outcomes. By mapping system frictions, our contributions, and intended outcomes, we believe we can better track progress, evaluate and manage risks, and demonstrate how our portfolio collectively advances our mission.

Our Theory of Change aims to connect:

- What we’re trying to achieve (North Star ambitions)

- How we’ll enable that change (S2G Contributions)

- How we know we’re on track (Interim and Long-Term Outcomes)

Our Theory of Change components are detailed below3:

- North Stars: The shared goals we aim to achieve by 2035, grounded in deep domain expertise and informed by stakeholder needs.

- Long-Term Outcomes4: The positive, systems-level shifts we aim to influence through our investments by 2035 and beyond, such as increased widespread adoption of clean energy, improved population and individual health, and positive nature outcomes.

- Interim Outcomes: Measurable, near- to mid-term changes (5 – 10 years) that indicate progress toward our North Stars, tracked through annual indicators that capture the outcomes of portfolio companies’ products and services. Examples include reduced emissions, improved resource efficiency, or reduced waste.

- Five Dimensions of Impact5: We embed the Five Dimensions (What, Who, How Much, Contribution, and Risk) into our sector Theories of Change as a strategic guide for connecting invested capital and contributions to both interim and long-term outcomes. This methodology is built into our underwriting process and aims to ground investment decisions in evidence and enable consistent evaluation.

- S2G Contributions: Our investor contributions, aligned across five focus areas, aim to support portfolio companies in addressing systemic challenges and strengthening enterprise value while driving progress toward our North Stars.

- Fit-for-purpose capital: S2G aims to provide fit-for-purpose capital through venture, growth, and special opportunities investments, backing companies with tailored financing solutions needed to scale systems-changing innovations.

- Operational excellence: We consider both the risks and operational resilience of our portfolio companies and practices to help maximize the positive outcomes of their products and services.

- Talent: We work closely with portfolio company management and boards to strengthen leadership capacity and position companies for sustained, industry-leading performance.

- Ecosystem engagement: We bring together investors, partners, experts, and industry leaders to encourage collaboration, share knowledge, and create new opportunities across our ecosystem.

- Government engagement: We collaborate with policymakers to provide education and resources to help ensure that innovative solutions are backed by effective legislation and regulatory frameworks.

- Fit-for-purpose capital: S2G aims to provide fit-for-purpose capital through venture, growth, and special opportunities investments, backing companies with tailored financing solutions needed to scale systems-changing innovations.

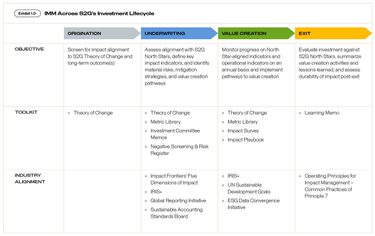

Integration Across Our Investment Process

We integrate IMM considerations into every stage of the investment lifecycle, from origination and underwriting to value creation and exit.6 Our IMM toolkit, which includes resources such as the S2G Metric Library, Risk Register, and S2G Impact Survey, guides internal processes at each stage. In addition, the S2G Impact Playbook complements these tools by providing a practical guide for portfolio companies to build their internal IMM capabilities over time. It outlines considerations at different stages of maturity, helping companies right-size practices while ensuring they remain both practical and effective.

Alongside assessing positive impact potential, we review risks and potential negative or unintended impacts as part of underwriting, identifying key issues and mitigation measures to track over time. We also recognize that reducing negatives, such as emissions or waste, can create meaningful positive outcomes, which we have tried to capture in our impact metrics as drivers of long-term value creation and resilience.

Looking Ahead

Our goal is to continue strengthening the integration of IMM across S2G’s processes and in support of our portfolio. By aligning capital with long-term outcomes, we aim to show that resilient business models and positive impact are not separate goals, but rather mutually reinforcing drivers of value creation. We also recognize that IMM is a journey of continuous improvement and remain committed to refining our tools, learning from our partners, and raising the bar for transparency and accountability as we position IMM as a competitive advantage.