Structural Trends Reshaping U.S. Agriculture

At the 2025 S2G Summit, our agriculture strategy session brought together diverse perspectives on the state of the farm economy. I had the privilege of sharing the stage with my colleague Francis Villante, Jason Trusley of Land O’Lakes, and Joby Young of the American Farm Bureau Federation. Our discussion centered on a critical question: Is today’s farm downturn just another cycle, or are we facing a deeper structural reset?

The evidence points decisively toward the latter.

The Farming ‘Triple Bind’

In past downturns, low commodity prices were often offset by falling input costs or a rebound in export demand. Today, farmers are experiencing a “triple bind”: depressed commodity prices, persistently elevated input costs, and high interest rates that have doubled operating loan burden. Even in strong planting years, farmers are delaying input purchases, cutting acres, or trading down to lower-quality inputs. These behaviors reflect both temporary hesitation and systemic cost pressures that are reshaping farm decision-making.

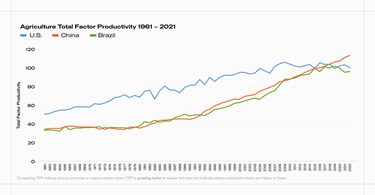

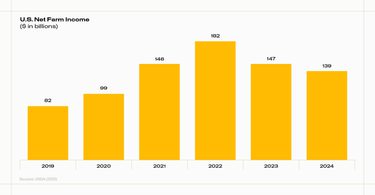

The structural nature of this downturn is compounded by U.S. agriculture’s slipping competitiveness. Brazil has overtaken the U.S. in corn and soybean exports, and unlike previous cycles, there is little expectation of regaining share simply through price recovery. At the same time, government safety nets have become less reliable. The 2018 Farm Bill was only extended through 2025, creating uncertainty at precisely the moment when net farm income has fallen more than 20 percent since 2022. Farmers are increasingly dependent on ad hoc support payments, which create volatility rather than stability in household finances.

For farm families, these structural dynamics translate into profound stress. With profitability squeezed, more farms are relying on off-farm income, taking on debt at higher rates, or deferring capital investments. The consequences ripple beyond balance sheets: delayed decision-making erodes resilience, labor shortages leave fields unplanted, and the weight of financial pressure contributes to worsening mental health outcomes in rural communities.

Joby Young underscored that policy must keep pace with these new structural realities, especially on labor and safety nets. With the passage of the “Big Beautiful Bill,” some uncertainty has been reduced, particularly on tax and crop insurance. But the larger forces we identified at the S2G Summit — structural cost pressures, declining competitiveness, and labor constraints — remain firmly in place.

Agriculture Solutions and Innovations

Yet even as the challenges are structural, so too are the solutions. We discussed several innovation pathways that can help reframe U.S. agriculture for the long term:

- Precision farming and automation can reduce input costs by optimizing application and minimizing waste. The adoption curve for these tools is accelerating, with technologies like “see-and-spray” systems showing measurable impact.

- Regenerative agriculture and biofuels offer opportunities to diversify revenue streams and decommoditize production, moving away from reliance on volatile global commodity markets.

- Financing innovations—from cash-flow management tools to crop-linked lending — can provide growers with better liquidity in a high-interest-rate environment.

- Supply chain optimization and domestic sourcing of critical inputs can mitigate some of the vulnerabilities exposed by trade disruptions and regulatory bottlenecks.

While these innovations have promise, Jason Trusley reminded us that growth, measured in total factor productivity, is the only true path forward. What resonated with me most was his recognition that U.S. agriculture has endured more than a decade of flat or declining productivity while global competitors continue to gain ground, and that reversing this trend requires more than scale or efficiency alone.

Trusley emphasized how critical it is to truly understand growers — their evolving behaviors, risk tolerance, and decision-making processes — and to design innovations and partnerships that meet them where they are. Only by responding to those perspectives can we begin to bend the productivity curve upward and restore long-term vitality to the sector.

I believe the current moment is not a passing storm but a structural reset. For investors, innovators, and policymakers alike, the imperative is to accelerate the tools and systems that allow farmers to adapt, differentiate, and thrive in a fundamentally changed environment. At S2G, our mission is to back those solutions, not only to deliver returns but to strengthen the resilience of America’s farms and the vitality of rural communities that depend on them.