Defining Adaptation: The Global Pivot to Resilience

In a compelling keynote at our 2025 S2G Summit, futurist, geopolitical strategist, and founder and CEO of AlphaGeo, Dr. Parag Khanna, laid out a sobering yet deeply actionable vision for how investors, policymakers, and companies must respond to our rapidly changing planet. His central message: The future belongs to those who invest in adaptation, alongside mitigation. As the world approaches 2.5 degrees Celsius of warming, reshaping geography, economies, and demographics, adaptation must be recognized as both a moral imperative and an unparalleled financial opportunity.

The Moral Crisis of Human Civilization

“There is no God-given solution to this existential and moral crisis facing human civilization. Right now, there is no United Nations, no COP Summit, no Biden or Trump or anyone who has the roadmap. The playbook is unwritten.”

- Dr. Parag Khanna

Khanna framed the global climate emergency not only as an environmental and economic challenge, but as a moral crisis of human civilization. Using the World Bank’s Suitability Index — a map showing where in the world conditions are becoming less suitable for human life — he highlighted a stark reality: Much of the global population, particularly the world’s youth, live in “red zones” — regions that are increasingly exposed to climate stress. Trapped by borders and underserved by global governance, these communities face rising climate risk with few clear pathways forward. In contrast, the “green zones” are those geographies that remain livable, investable, and stable in a warming world.

Khanna argued that the consequences of climate migration, economic erosion, and asset mispricing are no longer future risks — they are current realities accelerating in severity.

Resilient Geographies as the World’s Most Precious Asset

“It is not the strongest of the species that survives, nor the most intelligent. It is the one that is most adaptable to change.”

- Charles Darwin, On the Origin of Species

Amid this daunting picture, Khanna argued that resilient geographies will emerge as the world’s most precious asset. As some regions face economic loss and depopulation, others will attract investment, talent, and migration. The supply of these resilient places — those better able to withstand climate volatility — is limited, which only increases their value. This creates what Khanna calls geographic arbitrage, or a reallocation of capital and people toward more future-fit regions.

At the heart of this shift is adaptation, which he defines not as a fallback plan, but as both the most urgent risk mitigation tool and the strongest investment thesis of our time. For investors, developers, and policymakers, building adaptation infrastructure — spanning food, energy, water, housing, and transport — is the foundation of long-term resilience and a profound opportunity to shape the future.

Resilience Is Mathematically Measurable

“Resilience is beautiful, but not like beauty. You don’t know it when you see it – you must measure it.”

- Dr. Parag Khanna

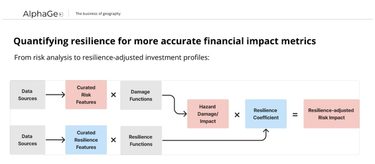

Central to Khanna’s thesis is a redefinition of resilience as a measurable metric, specifically, risk minus adaptation. His firm AlphaGeo calculates this on a scale from 0 to 100 for every location on Earth, providing a dynamic and actionable understanding of resilience. Rather than treating resilience as an abstract or philosophical idea, Khanna emphasized that it’s something that can — and must — be quantified. This allows governments, businesses, and investors to identify where their assets are underprepared and to target specific adaptation measures that close the resilience gap.

Crucially, Khanna stressed that resilience must be built into financial models to drive meaningful action. Simply knowing that assets are at risk isn’t enough. Investors need to see how adaptation impacts insurance costs, capital expenditures, future valuations, and return profiles. By translating adaptation into the language of finance, asset managers can scale investment in resilience and unlock capital flows toward solutions. In this way, adaptation becomes not just a protective strategy, but a systemic investment opportunity with long-term economic value.

Adaptation as a Systemic Investment Opportunity

“Adaptation is an inevitable and significant investment opportunity.”

- Dr. Parag Khanna

Khanna positioned adaptation as an existential necessity and a systemic investment opportunity. While decarbonization has drawn attention as a global public good, benefiting all humanity, adaptation is a local, private good. Building a seawall or drought-resistant infrastructure protects a specific place, not the entire planet.

However, in an interconnected world, Khanna argued that collective adaptation investments can deliver global benefits, from reducing climate-driven migration to mitigating food insecurity. This shift in framing — from isolated protection to shared resilience — makes adaptation morally imperative and economically strategic.

Khanna also highlighted a critical funding gap. According to the World Economic Forum, adaptation requires at least $2 trillion annually, yet current global infrastructure spending falls well short. Regardless of how successful mitigation efforts are, the need for adaptation remains unavoidable according to climate models.

Encouragingly, Khanna cited that adaptation investments come with multiplier effects and strong economic returns, boosting commercial yield across sectors like utilities, agriculture, and real estate. As new research continues to validate these benefits, Khanna called on long-term, mission-driven capital to recognize adaptation not as charity or insurance, but as a generational investment opportunity.

Building the Roadmap

“What are we going to do about the moral crisis of a world being divided into red zones and green zones? The answer is, we’re going to have to build our way out of it.”

- Dr. Parag Khanna

Khanna argued that the United States is uniquely vulnerable to climate risk — not only because of its geography but also due to underinvestment in adaptation. With more frequent and costly disasters than Europe or Japan, he believes the U.S. can’t afford to wait for others to lead. Yet, federal cuts to climate response agencies like FEMA and NOAA expose a growing adaptation gap. Still, Khanna sees opportunity in shifting incentives away from reactive rebuilding to drive smarter relocation and innovation in housing, infrastructure, and land use, particularly in more resilient regions. By combining predictive migration modeling with granular resilience data, Khanna’s work reveals where future climate havens could emerge and urges policymakers and investors to proactively develop them.

Globally, Khanna envisions a “living map” of infrastructure, migration flows, and resilient geographies — and he called on leaders to help build it. As climate shocks displace millions and reshape economic geographies, the world must match people to resources and technologies to need. His closing call to action is clear: we must build our way out of this planetary crisis — not by waiting on top-down mandates, but by creating bottom-up solutions rooted in resilience, mobility, and foresight.

The S2G Summit is our annual convening of industry executives, innovators, investors, policymakers, and influencers shaping the future of food & agriculture, oceans, and energy. This year, our theme was The Age of Adaptation, diving into four forces shaping the future — AI, geopolitical realignment, changing monetary regimes, and climate adaptation. Dr. Parag Khanna has kindly offered to share his slides from the event, which you can download here.